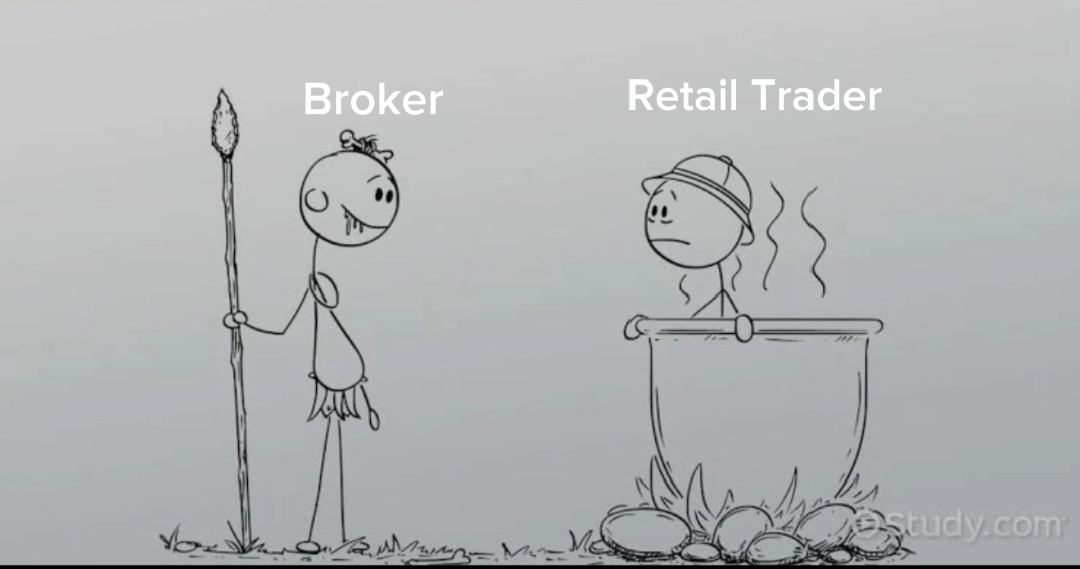

Broker Cannibalism, A Retail Trader’s Worst Nightmare (A Two-Part Series)

Google defines a broker as an entity that arranges transactions between a willing buyer and a seller, to get a commission when the deal is executed and successful.

In the financial market, this same definition also applies, as a broker could either be an individual or a company that arranges and executes financial transactions on behalf of another party. This financial transaction can be done across different assets in the financial market, assets like.

- Real Estate

- Insurance

- Stocks

- Forex…….and so on.

A broker always charges a commission for each order made by willing buyers and sellers in all of the mentioned asset classes.

In this article, I will be discussing the following topics.

Part One:

- What is a spread

- Spread Hours

- Good Spread and Bad Spread

- Types of Brokerage Trading Accounts

- Spread Accounts

- Commission Accounts

Part Two:

- Signs Your Broker Is Cheating You

- A-booking and B-booking

- Broker Manipulation (Slippages and Stop hunts)

- Selecting Brokers

- Regulated Brokers

- Un-Regulated Brokers

- Conclusion

- All we’ve talked about (recap)

- My Two Cents

Part One

What is a Spread

Just like when you go to the market to buy something, there is a price that the market vendor sells that particular thing to you and this price is different from the price the vendor bought it at, also if you want to sell the same thing you bought from the market to a friend you will sell it at a different price than you bought it, that difference is what is called a spread.

A broker in the financial market operates similarly, they charge you for buy and sell transactions you make in the financial market, the following are the different price points that a broker uses in charging its clients.

- Ask Price

- Bid Price

- Spread

Ask Price: When you want to place a ”buy” order in the market, and you see the price level the market is at the present moment according to your broker, it is usually a little above the original raw market price level, and this is because that difference is what your broker charges and makes as a profit on that particular transaction, so, therefore, your broker gets paid the moment you place that order, whether you were profitable or not after the order was closed.

The inner workings of such a thing require that the price must go way past your broker’s ask price higher before a profit is recorded in your books, if the price lingers around your broker’s ask, even though it is above raw market price, this would still be a floating loss, so therefore, your broker owns the difference from the raw market price level to the ask price shown to you by your broker feed.

Bid Price: When you want to place a “sell” order in the market, and you see the price level the market is, at the present moment according to your broker, it is usually a little below the original raw market price level, and this is because that difference is what your broker charges and makes as a profit on that particular transaction, so therefore your broker gets paid the moment you place that order, whether you were profitable or not after the order was closed.

Just like the Ask price the inner workings of such a thing require that price must go way past your broker’s bid price lower before a profit is recorded in your books, if the price lingers around your broker’s bid, even though it is below raw market price, this would still be a floating loss, so therefore, your broker owns the difference from the raw market price level to the bid price shown to you by your broker feed.

Spread: The Spread is the Difference between the Ask and Bid price, simply put. Essentially the spread is the broker’s profit or better put “commission”, this commission takes different forms which will be discussed in later parts of this article as a whole.

For the spread, different things determine how large or small a broker spread will be and these factors include Liquidity, Volatility, Broker’s Policies, and spread hours.

Very liquid markets usually have tighter and more favorable spreads.

During times of peak Volatility example, news events, the spreads can widen up.

Some brokers usually have wider spreads than some, depending on their regulation status and a host of other factors.

During spread hours the spreads usually widen from the hours of 10 pm WAT and begin to tighten, an hour later up until 00:00 am WAT.

Spread Hours:

Spread hours is a very important must-know for every trader, especially new traders, cause trust me, you are not ready for the type of swing it can do to your open trades, in terms of floating profit or loss.

During spread hours, the broker spreads usually widen due to the illiquid nature of that time of day, as there are no willing buyers or sellers, so therefore brokers must protect themselves from potential losses associated with executing orders, then para-adventure sudden price movements occur.

Quick story:

I had a really bad experience with spread hours some time back, which I took account of as you can see in the picture above, also look at the time this thing happened (Nigerian Time) WAT.

I took a trade but during spread hours, the spread widened up and eroded all my floating profits, putting me in a running loss although technically I was supposed to be in a profit, judging by the distance away from my entry point, the spreads open so wide and was increasing rapidly that as the price was moving more and more in my favored direction, the loss kept getting bigger, this was a very confusing moment for me as a trader as I have been in the financial market for over 3 years at the time such a thing happened.

I called trader friends to explain my situation, and a lot of them were also confused as to how this was going on, I kept calm, but a lot of thoughts went through my mind, I even thought of suing the broker which led me to take a screen record of the situation live, LOL.

But to my amusement, towards the hours of 00:00 am, the floating profit and loss started correlating to the technical price action as the spreads cleared up slowly, then I realized this was just a basic matter of spread hours, you can imagine the relief I had that day as I could now go back to sleep knowing fully well my broker wasn’t out to get me.

So, traders, it is a must to be aware of these hours in the market, so you won’t be taking a trade at this time.

Good Spread Bad Spread:

There are standards in the trading sectors as to what spreads brokers charge on each currency pair, depending on whether they are major, minor, or Exotic pairs.

Now using the foreign exchange market as an example, I want to talk about the standard pips per spread on currency pairs during normal trading hours that you will find most brokers charging.

For major pairs like Eurusd, Gbpusd, and Usdcad the standard spread is usually from 0pips to 1.3pips for the spreads during peak hours.

For Exotic pairs like the Cadjpy, Eurnzd, and Chfjpy, these could go from 2pips to as high as 3pips during peak trading hours.

Good Spread: Good spreads are usually within the range of the standard spreads I mentioned, but depending on your broker about 0.3 pipet differences could be there, which isn’t much and still in the range of something healthy.

Bad Spread: Now bad spreads are very common among non-regulated brokers and you will begin to see spreads on major pairs going for as much as 3pips even on normal days, this isn’t a healthy spread as this denotes when you make either a buy or sell order, price must move in your directions 3 whole Percentage in points (PIP) before you begin to see any profits, this is a lot and should be recognized as a bad spread.

Types of Brokerage Trading Accounts

Now, we are in the final points of the part 1 article, and I want to talk about the different types of trading accounts and how they differ in the ways the broker charges its commission.

There are basically two types of brokerage trading accounts you can open

Those are.

- Spread account

- Commissions/Raw Spread account

Spread: In this account, the broker charges you about the standard pips per spread on the majors, which can be a little higher, but it will be within the range of the standard they should charge and can be around a .3 pipet difference for major pairs like the EURUSD and GBPUSD.

Commissions/Raw Spread: in this account, as the name implies, the broker places no spread and gives you the price at the raw market value without any higher or lower price and the close of every order. The amount charged is highly dependent on the broker, lot size, and whether they are regulated or non-regulated, but you should do comparative research on the different brokers to see the broker with the lowest commission and of course, you have to be careful to choose a reputable broker or you can be a victim of unscrupulous brokers, we would look at this topic of bad brokers in the next parts of this article.

Thank you for reading. We will meet again next week!